us capital gains tax news

Just like income tax youll pay a tiered tax rate on your capital gains. September 15 2021 455 PM MoneyWatch.

Do Nonresident Investors Pay Capital Gains Tax Fox Business

Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

. Preckwinkle announces loan program for towns and schools that. The plan released by the House Ways and Means Committee Monday sets the top rate for taxing capital gains -- money earned from the sale of assets such as stocks or property. News 04 November 2022.

A website that describes itself as promoting popular capitalism is urging the government not to consider raising Capital Gains Tax on landlords and others in this. Real estate properties generate income for investors but taxes play a factor in returns. News about Capital Gains Tax including commentary and archival articles published in The New York Times.

Learn about long- and short-term capital gains tax on stocks the tax rate and how you can minimize taxes on capital gains. By Rocky Mengle Published 19 October 22 Capital Losses. Top Stocks to Buy in 2022 Stock Market.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. 2022 capital gains tax calculator. Read all the latest news on Capital Gains Tax.

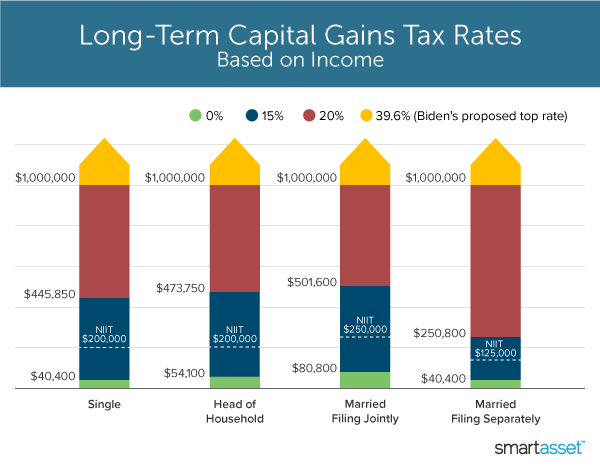

2022 federal capital gains tax rates. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. The capital gains tax applied to profits from the sale of section 1202 qualified small business stock and collectibles is 28.

Late property tax bills in Cook County will be due by years end. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. For example a single person with a total short-term capital gain of.

For example a single person with a total short-term capital gain of 15000 would pay. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

In the United States of America individuals and corporations pay US. The estate tax exclusion will grow in 2023 to 1292 million from 1206 million in 2022. The top federal tax rate on capital gains could reach levels not seen since the 1970s under the House Democrats proposed 35.

Long-Term Capital Gains Taxes. That means that until your estate exceeds 1292 million you will not owe any tax. Capital Gains Tax News.

Capital Gains Tax in Real Estate Investing. In some cases the IRS levies a tax of 25 on. Rules to Know for.

Australia Wont Stop Charging Capital Gains Tax on Crypto. With average state taxes and a 38 federal surtax. Latest news headlines analysis photos and videos on Capital Gains.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. For 2023 you may qualify for the 0 long-term capital gains rate with taxable income of 44625 or less for single filers and 89250 or less for married couples filing jointly.

Chancellor weighs up rise in capital gains tax in bid to fix 50bn black hole. 1 day agoBreaking News. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

State Taxes On Capital Gains Center On Budget And Policy Priorities

Short Term Capital Gains Tax Rates For 2022 Smartasset

U S Chamber Of Commerce Releases Report Examining Impact Of Capital Gains Tax Hike Financial Regulation News

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

Markets Eerily Silent Amid Surprise Report On Capital Gains Tax Hikes

What S In Biden S Capital Gains Tax Plan Smartasset

The States With The Highest Capital Gains Tax Rates The Motley Fool

The History Of Capital Gains Taxes The New York Times

Crypto Taxes Usa 2022 Ultimate Guide Koinly

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Why Higher Capital Gains Taxes In The Us Might Be Bad News For Bitcoin Moneyweek

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Capital Gains Tax Under The American Families Plan Marcum Llp Accountants And Advisors

Rich Americans Would Dodge Biden S Proposed Capital Gains Tax Hike Study Says Fox Business

Capital Gains Tax In The United States Wikipedia

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Capital Gains Full Report Tax Policy Center

House Democrats Capital Gains Tax Rates In Each State Tax Foundation