when will capital gains tax rate increase

Up to now the tax rate on capital gain has been zero 15 or 20 depending on your income. The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition events.

Eliminating Stepped Up Basis Could End Family Farms Texas Farm Bureau

Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession.

. The finance minister is reviewing changes to the. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. The proposal would increase the.

Thus for households earning more than 1 million the capital gains tax rate would increase from 238 to 434 as of April 28 2021 thus eliminating the opportunity to. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Long-term Capital Gains Tax Rates for 2021.

Could capital gains taxes increase in 2021. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. In some cases you must add the 38 Obamacare tax but at worst your total tax bill is.

In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000 according. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. The effective date for this increase would be September 13 2021.

Note that short-term capital gains taxes are even higher. Just like income tax youll pay a tiered tax rate on your capital gains. The tax hike would apply to households making more than 1.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. The long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15 or 20 of the profit depending on the income of the filer. The effective date for this increase would be September 13 2021.

Tuesday May 3 2022. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers. Hunt is also looking at increasing the headline rate of capital gains tax CGT The Telegraph reported later on Thursday.

The new rate would apply to gains realized. The proposal would increase the maximum stated capital gain rate from 20 to 25. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

If this were to happen it may not only seem unfair but it is also bad tax policy. And under the latest tax legislation the long term capital gains rate for those in the 396 tax bracket rose to 20. The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition.

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. 2023 capital gains tax rates. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to 900000 of the deferred gain.

The house ways and means committee released their. The capital gains tax is based on that. Capital gains taxes on assets held for a year or less correspond to ordinary.

22 2021 at 1256 pm. The new rate would apply to gains realized after Sep. When will capital gains tax rate increase.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. With average state taxes and a 38 federal. This would take effect in 2022.

For example a single person with a total short-term capital gain of 15000 would pay 10 of 10275. This will result in.

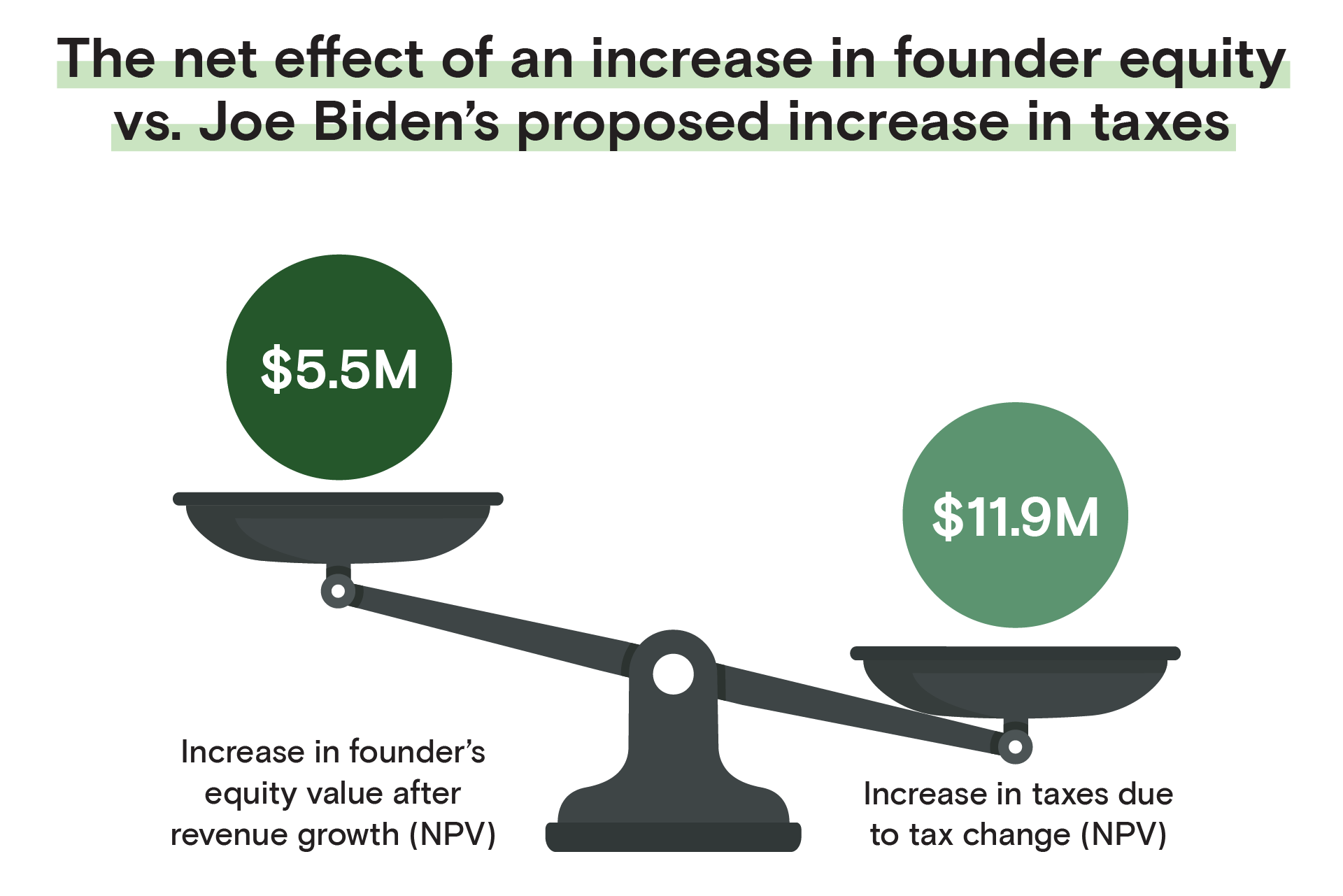

For Founders The Implications Of Joe Biden S Proposed Tax Code

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

Capital Gains Tax In The United States Wikipedia

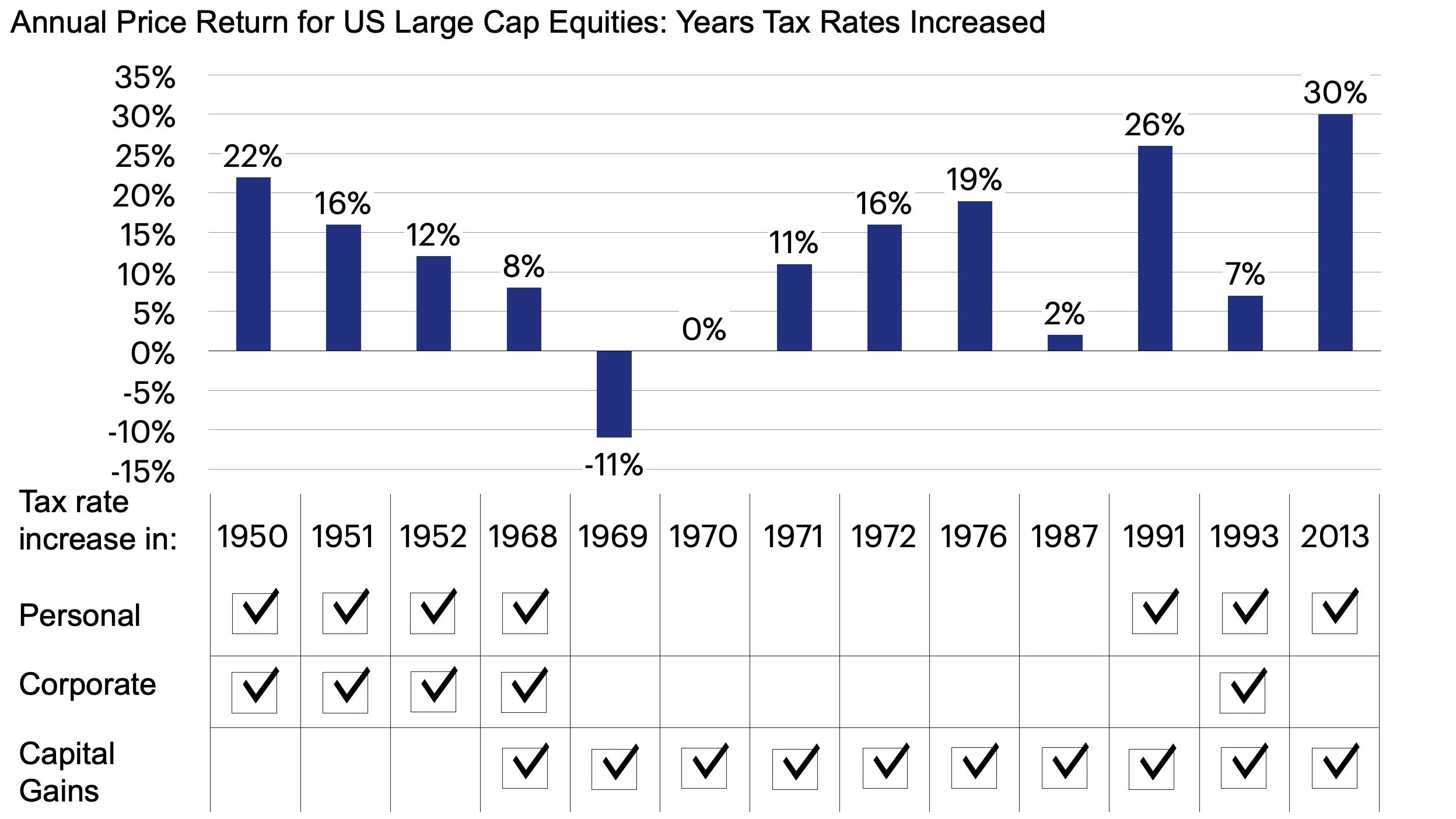

Will Tax Hikes Kill The Bull Market Invesco Us

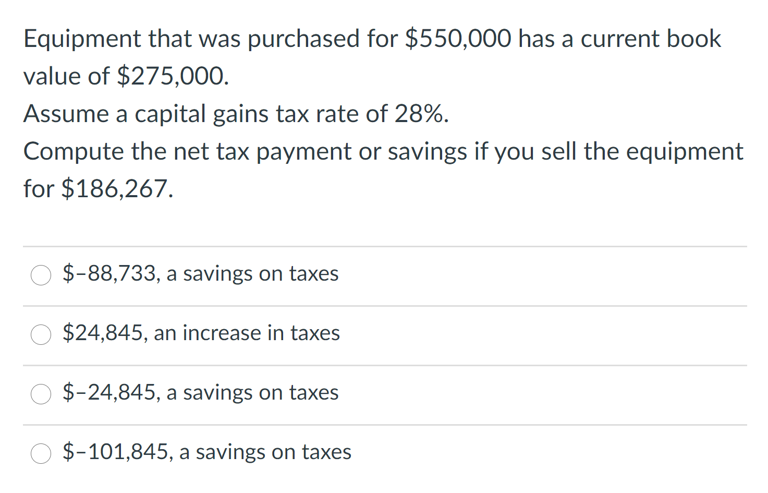

Solved Equipment That Was Purchased For 550 000 Has A Chegg Com

Carl Quintanilla On Twitter Correlation Between Capital Gains Tax And Market Returns 1968 2021 Via Johnspall247 Https T Co Gkocg8xlrw Twitter

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

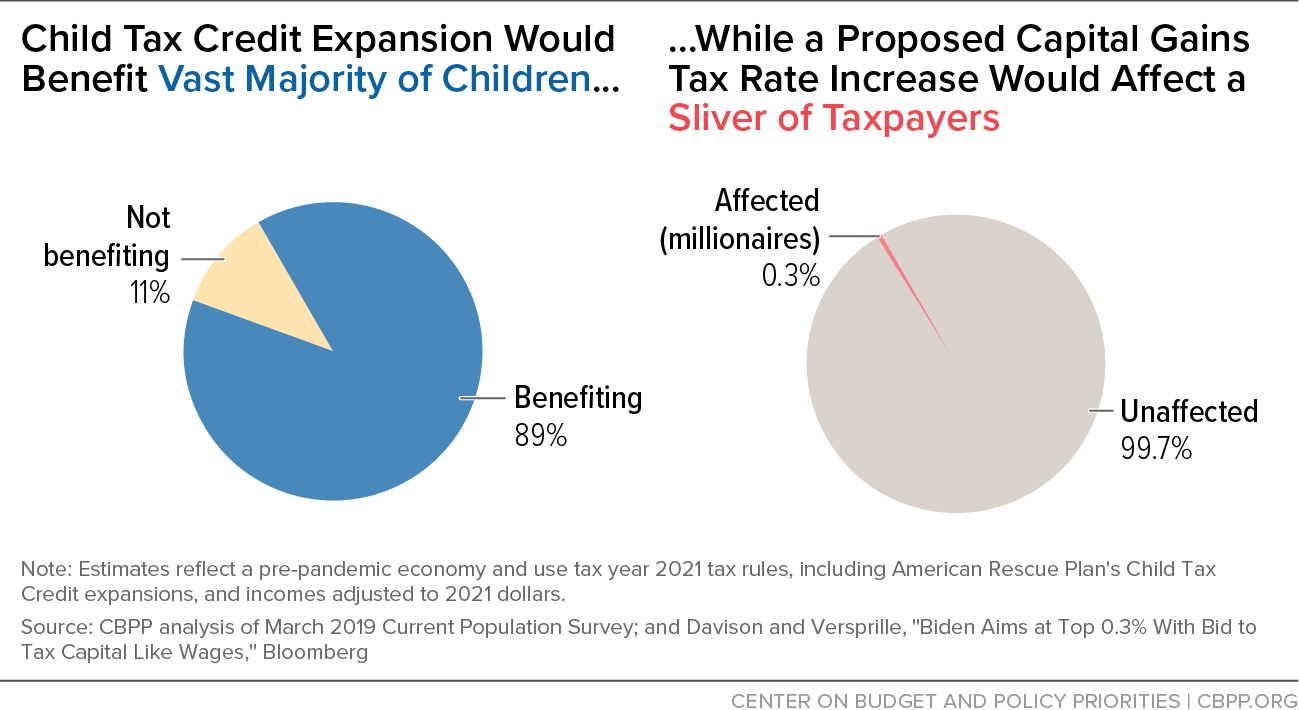

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

Capital Gains Tax Under The American Families Plan Marcum Llp Accountants And Advisors

The Bush Capital Gains Tax Cut After Four Years More Growth More Investment More Revenues

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Will Tax Changes Sink The Market Creative Planning

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Can Capital Gains Push Me Into A Higher Tax Bracket

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)